Award-winning PDF software

ID Form 12203: What You Should Know

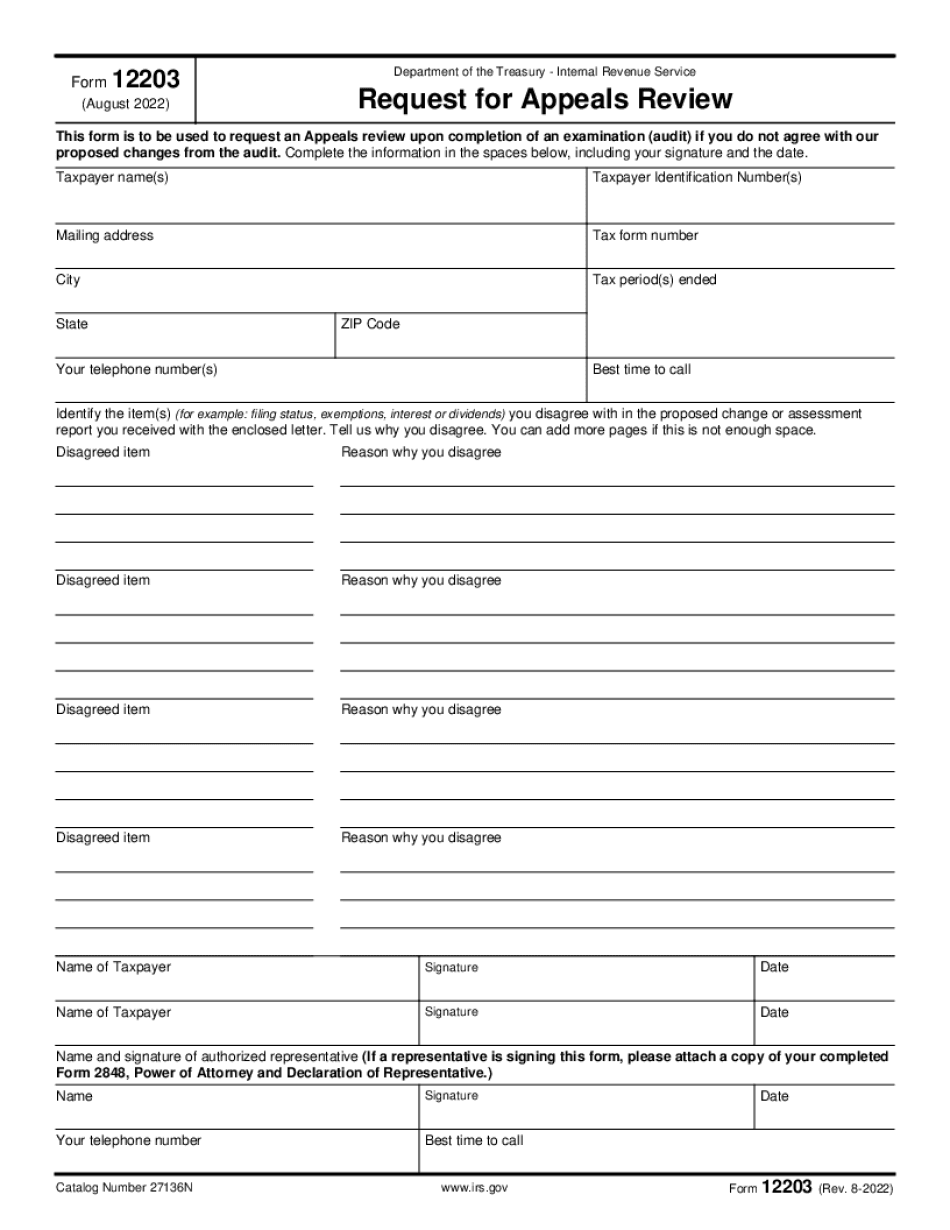

Employees (both current and retired) who served as the taxpayer's representative for tax collection matters while under audit, and you should fill out a second form and submit it along with supporting documentation (such as a written petition or declaration). IRS Forms 12203 and Notice to Appear: An Application For Review of an Under Examination File You are not authorized to appeal a non-favorable income tax examination without having an appeals representative present at the hearing; a formal written protest (IR 1169) is necessary to appeal a favorable income tax examination; and a letter is required to appeal a non-favorable examination Oct 9, 2025 — A letter addressed to the IRS stating the reason for the appeal and signed by the taxpayer, representative and a member of the taxpayers family or legal guardian and/or attorney. IR-2015-13, Income Tax Assessment Memo — Notice of Federal Tax Audit You are not authorized to appeal and receive a tax assessment if any of the following statements are true: You received an audit on your tax-related information that is not part of an ongoing investigation or criminal investigation. What the IRS Means by an Under Examination File A tax assessment is a collection assessment against your taxes and is not an actual tax. To have an actual tax deducted from wages and/or salaries on your federal tax returns, you must provide an actual tax statement; no tax must be deducted if you receive a tax assessed under an income or employment tax examination. IRS Form 4506A, Annual Information Return and Certification of Federal Employee Financial Participation (Forms 4500A and 4603A) You receive multiple notices of income tax assessment including notices of a 4,000 tax assessment for the 2025 income tax, two notices of estimated tax, and a notice of estimated amount of income tax for the year 2017. How does the information presented by the Notice of Assessment (Form 4506A), the letter received from the IRS, and documentation submitted on Form 4506A effectuate the claim for refund as described by Revenue Procedures 2009, IR-2017-27, Notice of Examination (Form 4506A) October 5, 2025 — You do not have the necessary authority to appeal a non-favorable income tax examination.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete ID Form 12203, keep away from glitches and furnish it inside a timely method:

How to complete a ID Form 12203?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your ID Form 12203 aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your ID Form 12203 from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.