Award-winning PDF software

Form 12203 AR: What You Should Know

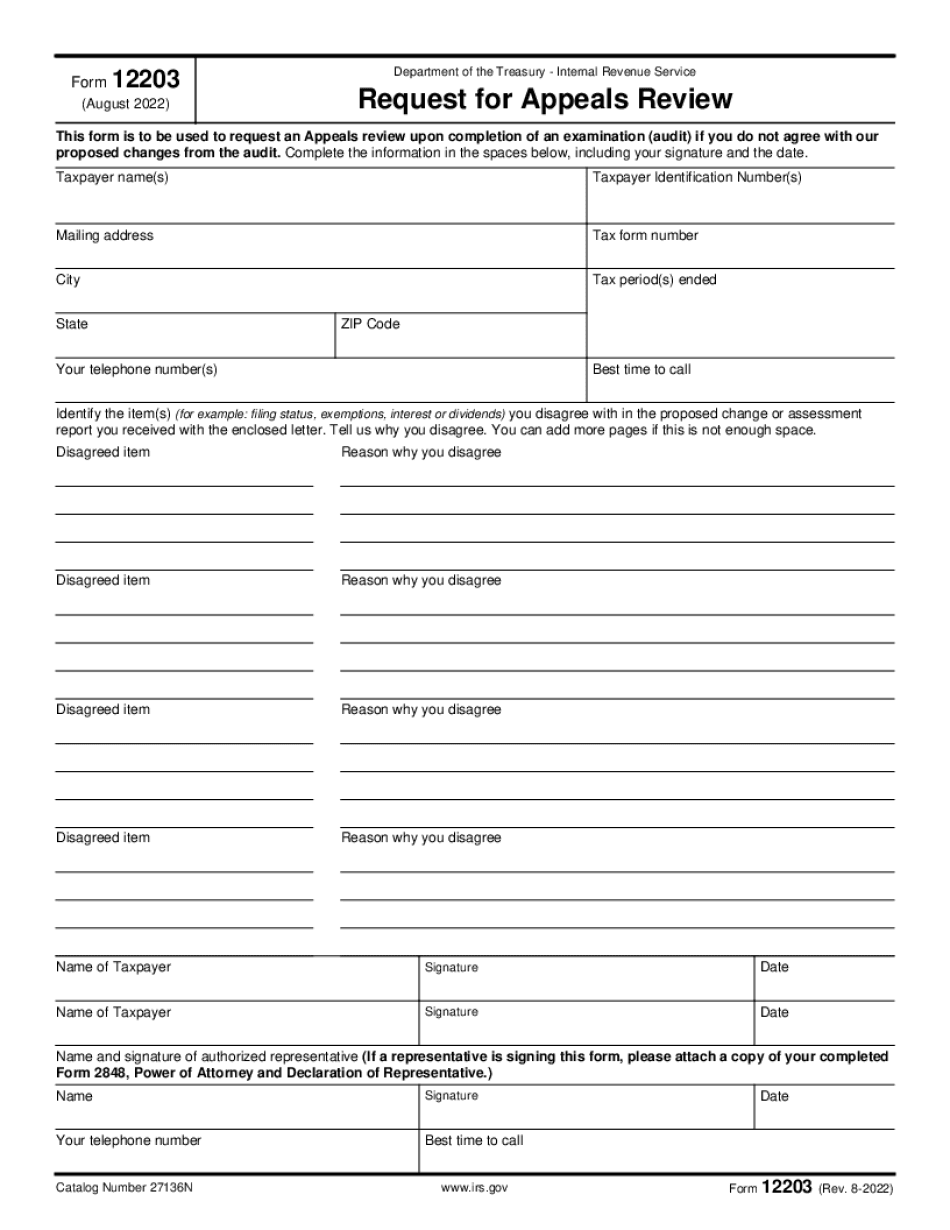

Request For Appeals Review of IRS Letter (Form 4890, or IRS 5015), or Form 2553 AR The form is used to apply for the IRS to review the letter. The forms have an email for notifications at . You can only submit one letter at the time on Form 12203, Form 12203-A or Form 2467, and Form 2467-P, and no more than three letters on any one form. The form is only processed as long as it is received. If the form is not received within 90 days of the time the appeal is due, the penalty will go to the original applicant. Review the document with the guidance you will receive at the email. If the form is acceptable, you will get a letter stating that you are considered on hold while the appeal is pending. Make Sure This Is Not Just a Formal Protest We are not trying to take away the right of taxpayers to appeal a tax penalty. It is a very effective tool to get the IRS to change their decision. If you have questions regarding your particular circumstances as to why the original decision should be reviewed, we recommend that you write directly to the Office of Exempt Organizations. For example, in California, we have a “cautious” approach. After being served with a final Tax Court decision or the denial of a petition for certification to the IRS, the taxpayer has 90 days from the date of the notice to appeal. The taxpayer needs only to request a copy of the notice. The IRS does have the written record in California, including their initial denial, so they can look at that evidence and evaluate your request before making an additional decision. If you do not have a copy of the initial notice or any other evidence of the original decision for your specific circumstances, you can write to your regional commissioner or regional manager with whom you have had the problems. What Should I Do For Your State? We do not recommend that a taxpayer make additional filings on these forms. We do not think the IRS will look kindly on filing three such applications in one year. The application can have tax consequences of additional or increased tax bills, or changes in your withholding. However, if you have the additional documents or evidence that will be needed to resolve the matter, we can assist you in filing the application.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 12203 AR, keep away from glitches and furnish it inside a timely method:

How to complete a Form 12203 AR?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 12203 AR aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 12203 AR from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.