Award-winning PDF software

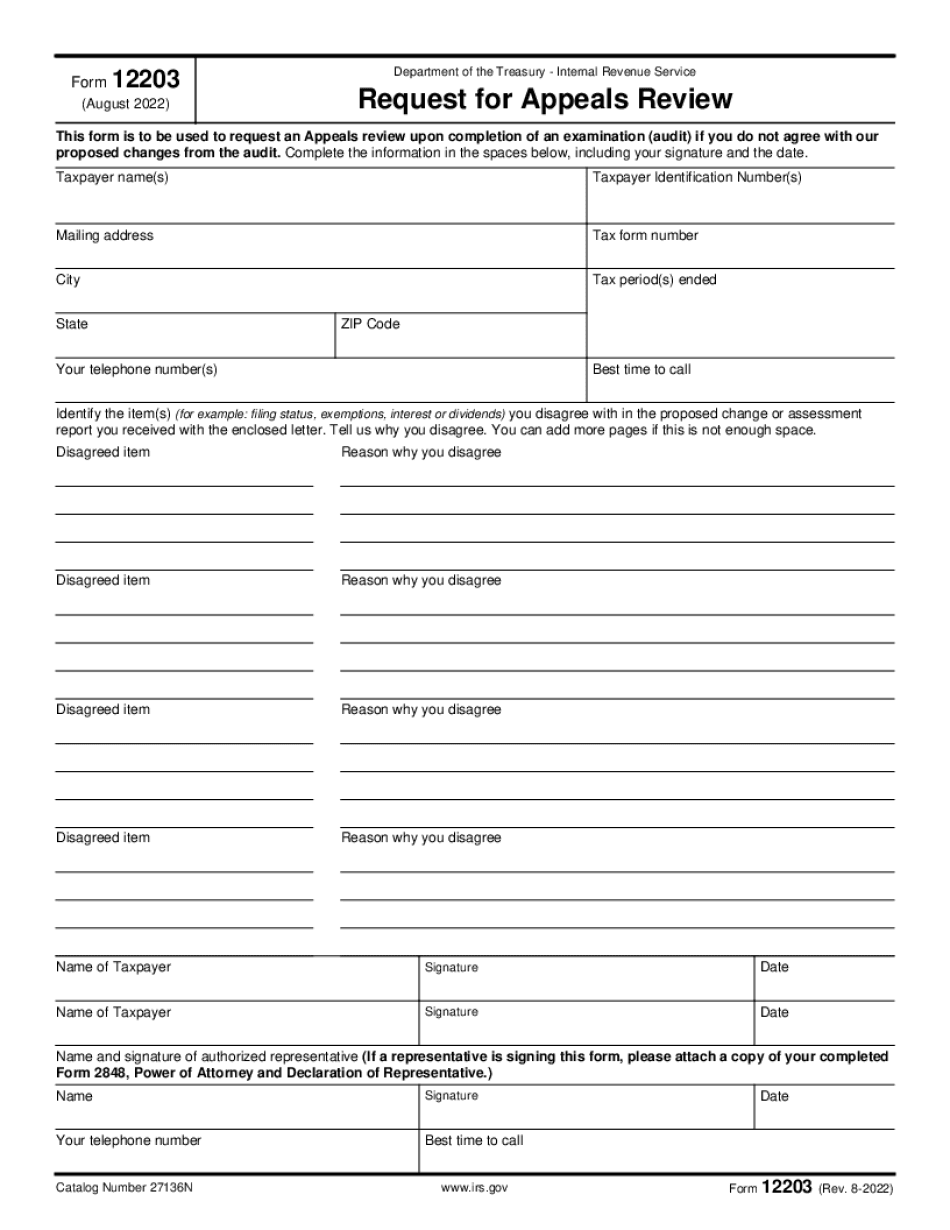

Printable Form 12203 Broward Florida: What You Should Know

You may have to return your request if an IRS representative refuses to hear it. (See IRS Notice 2013-54) Fillable Forms 12203 — PDF liners. If you are making a request using a form, the completed document must be received at a taxpayer's address within five calendar days, if the original is received within 10 days of the original requesting the review. The taxpayer must receive the complete document without cuts or breaks to avoid delaying consideration of your request. If you are sending an item without a document, you may mail the item or return the completed request form separately. Send the completed request form within 10 calendar days, but allow a total of 20 or more calendar days. You can choose to request another item or the entire record of service. In addition, you may choose this form if you're appealing a Letter 4890 Notice of Denial or a Letter 5015 Notice of Revocation. The taxpayer receiving the request for review (or a representative) will review your request. Fillable Forms 12203.pdf (10-Page) The request must include the following items: · The item (or request) (Form 12203) · A statement that the item has merit or is within one of the taxpayer's legitimate claims in the area of concern. Examples of legitimate claims vary depending on your relationship to the IRS's issues with this item or service. · A statement that the taxpayer is knowledgeable about your situation and that they can help provide additional information necessary to make a reasonable determination. · A reference to the relevant document, if requested, or any additional information the taxpayer needs to resolve the issue. · A statement that the items are not disputed, or that there will be no resolution. · A statement indicating your understanding that your request will be reviewed and, if appropriate, you will receive additional information within 10 calendar days (or 20 or more calendar days, if requested) and your request will be resolved. · Please indicate that you understand that you are responsible for collecting information for review. Send completed form, with accompanying statement, to: Attention: Commissioner of the IRS P.O. Box 4999 St. Petersburg, FL 33770 For more information and a list of available forms, read Form 12203, Request for Review or Appeal of an item or the complete list of forms in PDF.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Printable Form 12203 Broward Florida, keep away from glitches and furnish it inside a timely method:

How to complete a Printable Form 12203 Broward Florida?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Printable Form 12203 Broward Florida aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Printable Form 12203 Broward Florida from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.