Award-winning PDF software

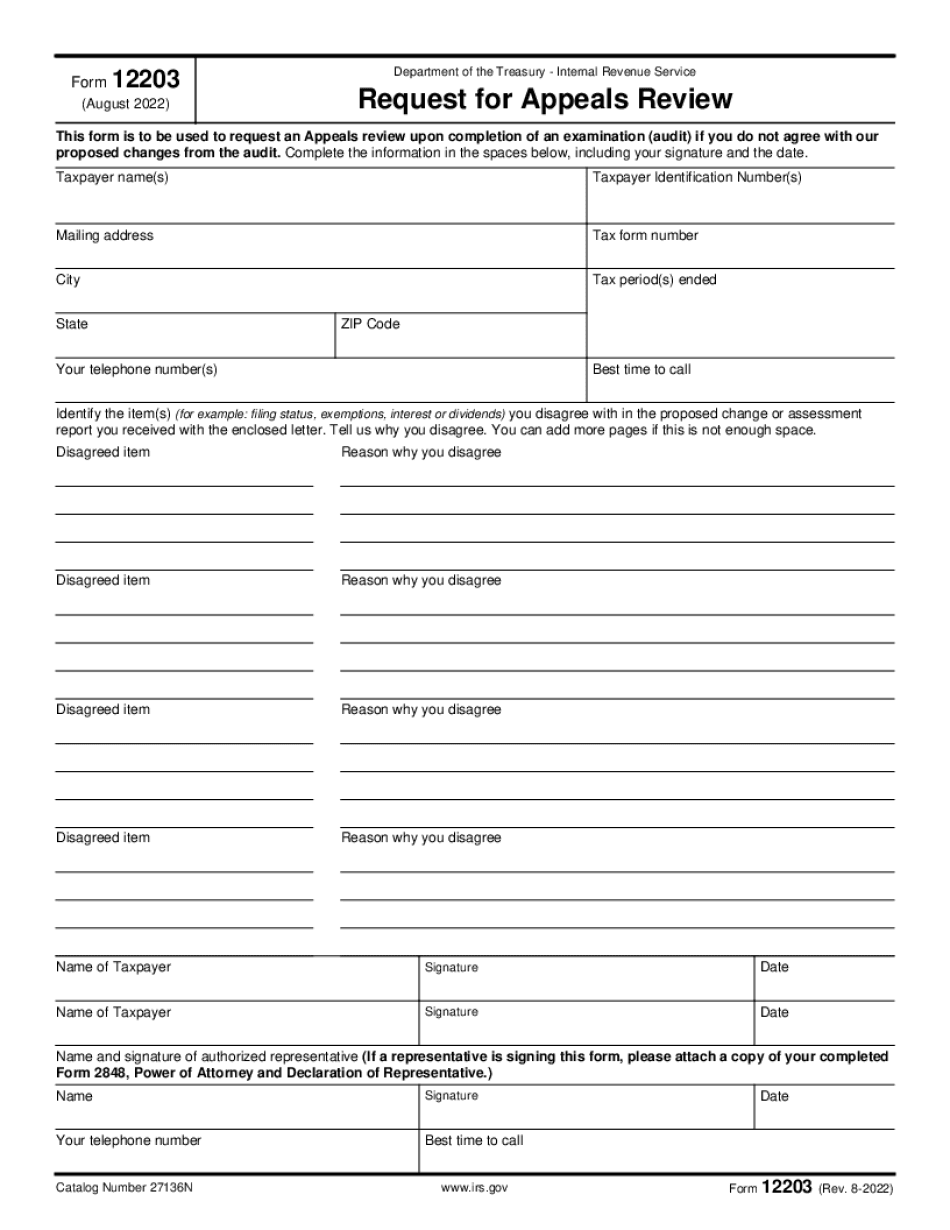

King Washington Form 12203: What You Should Know

Department of General Services (WSD) and administered by the State Historic Preservation Office. King | Washington Department of Revenue Washington State Department of Revenue Tax Forms State Form 478 (Tax Return). Form 478, Statement of Receipt for Property. State Form 1021-A. Form 11, Application for Individual Tax Exemption for a Single Head of Household Filing Status: Single Eligibility Criteria: Married (two people required) Filing Status: Married (Note: If you are a head of household and the spouse is a disabled adult, you are eligible for the adult exemption, you will also need to receive a tax payment waiver before filing form 11) Eligibility Exemption Type 1: Single or HUSBAND ONLY (only one person may be eligible for this exemption); OR: Head of Household Eligibility Exemption Type 2: Married OR (Only one person may be eligible for this exemption); OR: One person or individual who is a disabled family member.) Exemption Amount: 0 (no cost to you) The Tax Collector can make an estimate for an amount to file on your behalf. The Exemption Exemption amount is the same at every tax season, regardless of the amount being withheld Exemption Amount is based on the estimated amount you are responsible for paying the tax. Exemption Exemption Amount is deducted from your tax for all past-due property taxes The Exemption Amount can't be increased or decreased later than 5 months after each tax month (except the property tax refund exemption, the Exemption Amount must be deducted from your tax for any owed property taxes paid, but not previously paid). Any Exemption Exemptions available must be in effect when the form 11(1)-B is filed. (If your Exemption period has ended, apply to the Clerk of the Property Tax Appeal Board in the tax levy division at your tax office for a new Exemption Exemption Period) Revenue agents require identification on Form 478, that shows the name, address and telephone number of the tax authority. Please make note the person you used the identification information to pay the tax. If you have an IRS-approved e-tax software system, you will not have to provide identification.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete King Washington Form 12203, keep away from glitches and furnish it inside a timely method:

How to complete a King Washington Form 12203?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your King Washington Form 12203 aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your King Washington Form 12203 from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.