Award-winning PDF software

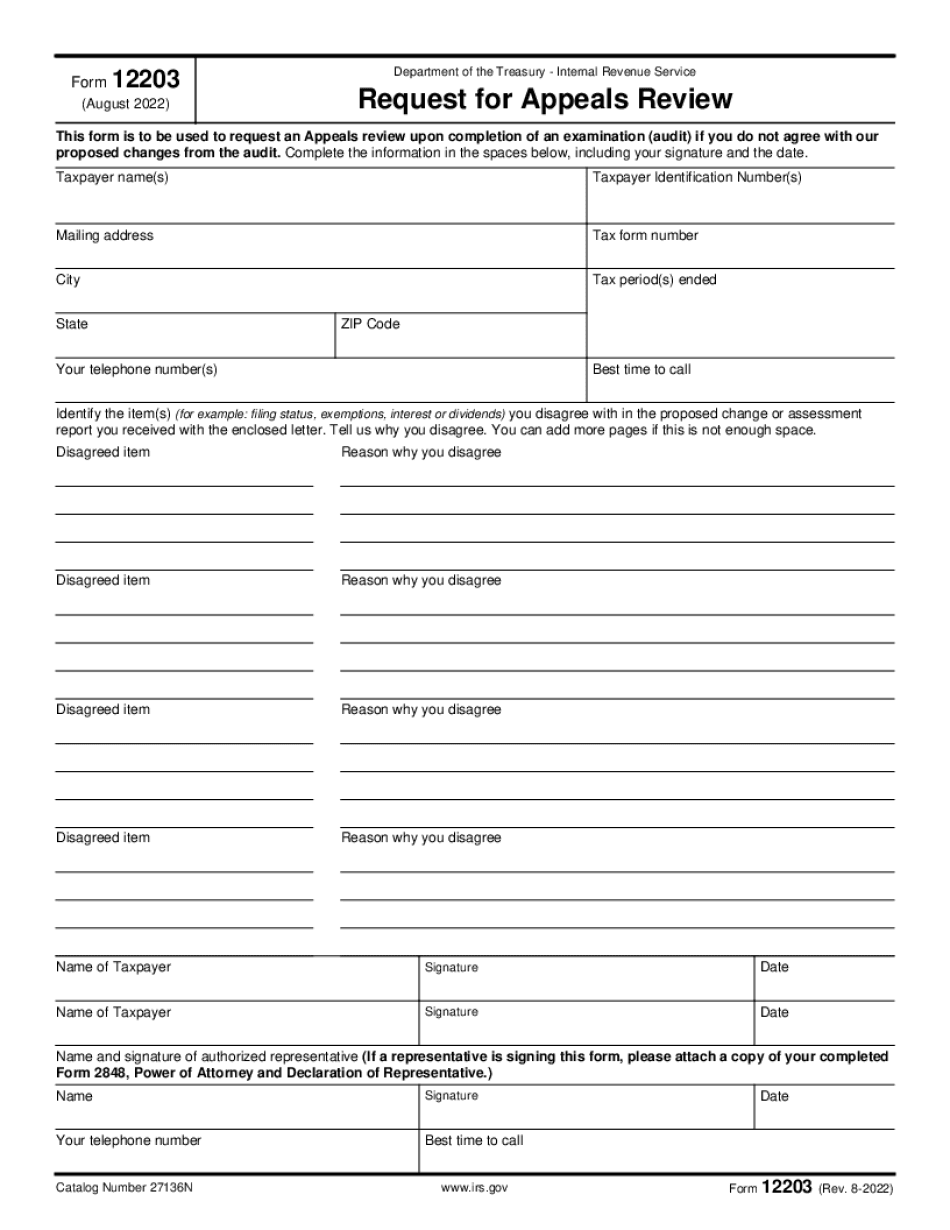

Form 12203 for Murrieta California: What You Should Know

Email: [email protected], Telephone:. Send all documents to: [email protected] A copy to your city can be requested The following forms are to be submitted for review and approval (no appeals will be reviewed). Form 2113-A — This form is for all people. (All documents should be sent to your city in PDF format. They can be delivered to a post office box or uploaded electronically to IRS.gov). This should be all that needs to be filed for reviews. Please note that this is not an actual IRS letter, and it does not include information about how the tax is calculated. A tax calculation is based on the amount of the tax withheld, the percentage, and the amount of each individual payment for every tax unit. An applicant is given a letter which has a lot of information on it. If you fill the form out exactly, you have to put in your own information, so the IRS does not use your information or return it. You will end up leaving some information out, so fill out the form out carefully. If you do not agree with the assessment of the tax or believe that you might have been unfairly overcharged or underestimated tax, you have the right to file an appeal. You should file a letter of appeal with the Taxpayer Advocate, Internal Revenue Service, P.O. Box 6200, Washington, DC 20. This is the last step towards obtaining correct, fair, and timely relief. For details, and how to file Form 2230-B for appeals, click here If the Taxpayer Advocate decides to review your appeal, you will receive a letter in your mailbox. The IRS Appeals System will forward the appeal to the Taxpayer Advocate for review. The Taxpayer Advocate will decide if you or the Taxpayer Advocate Unit at your city will receive the refund due. If there is a problem with the decision taken by the Taxpayer Advocate, an appeal of the decision may also be filed. A tax adjustment letter is issued to taxpayers. This letter informs the taxpayer of the amount of the adjustment and how these dollars may be used. You should make copies of all your records and keep them for yourself or for the return or filing of your taxes and for reference. A photocopy of the record will help you explain how you came to the calculation of the tax. A certified copy will make it easier because the tax official cannot examine the record and compare it with something else.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 12203 for Murrieta California, keep away from glitches and furnish it inside a timely method:

How to complete a Form 12203 for Murrieta California?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 12203 for Murrieta California aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 12203 for Murrieta California from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.