Award-winning PDF software

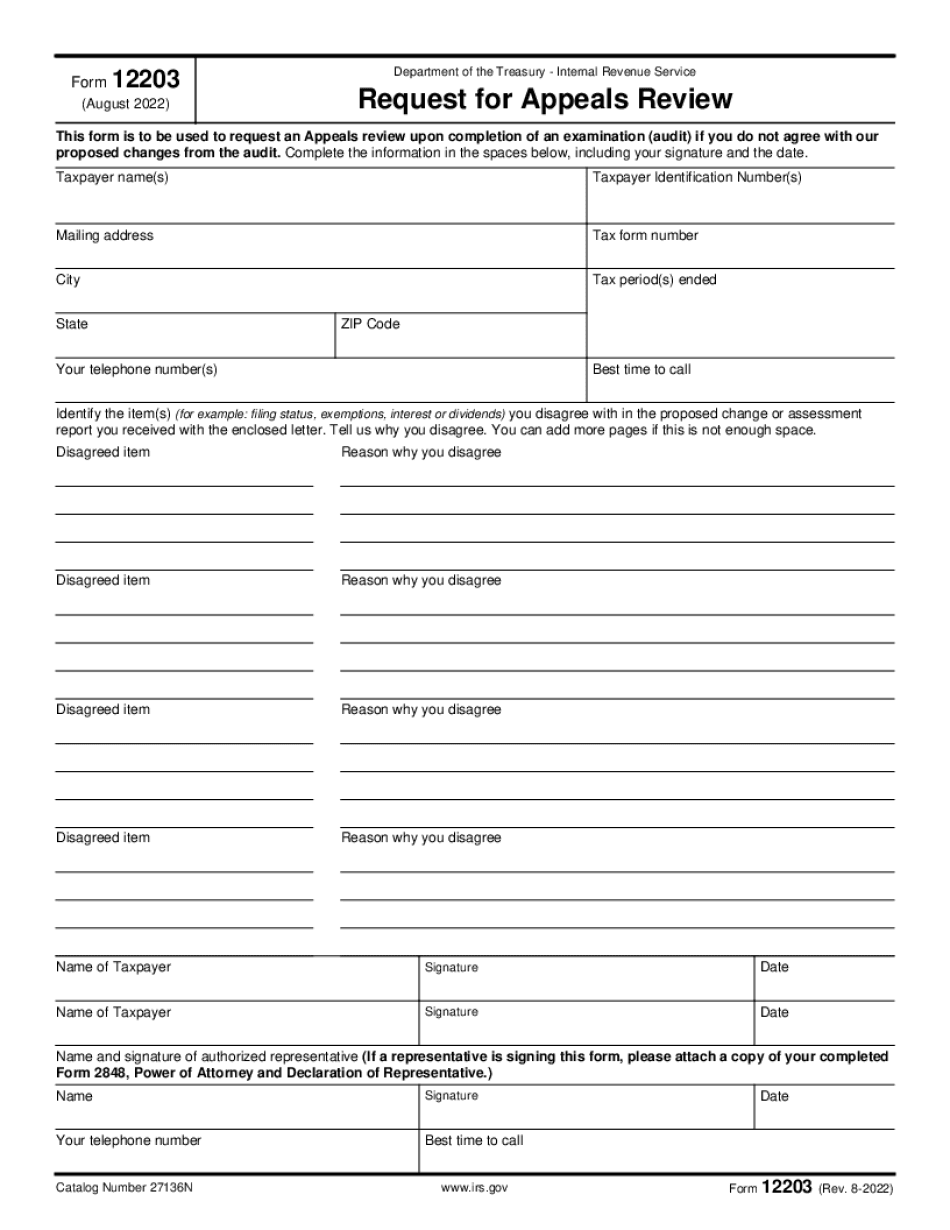

Form 12203 Escondido California: What You Should Know

Form 1099-A Tax Return for Individuals with Annual Household Income of 6,350 1-15 Affidavits and claim forms for exempt entities filing period(delinquent at 5:00 p.m. on 2640 Glen Ridge Rd, Escondido CA 92027 … 10206 S. Escondido Ave, Escondido CA 92025 … 1-15 Affidavits and claim forms for exempt entities filing period 2640 Glen Ridge Rd, Escondido CA 92027 … 1-15 Affidavits and claim forms for exempt entities filing period 2640 Glen Ridge Rd, Escondido CA 92027 … 1-29 Taxpayer Information Returns for Form 3695 1-13: Annual Declaration for Exemption from Federal Income Taxes for Persons Not Appearing in Person … 1625 Foothill Trail, Suite A, North San Diego, CA 92020 … 1-27 Taxpayer Information Returns for Form 2853 Form 3106.3-T (U-form), Federal Insurance Contributions Act Tax Return. Form 3106.3-T (U-form) is a tax return provided for self-employed individuals, and for certain other dependent taxpayers. The Form 3106.3-T is a completed tax return and must contain correct documentation to substantiate the self-employment income of the individual. The self-tax return is considered a separate return for the purposes of the employer-side and employee side tax laws. If the individual pays self-employment income to the IRS, you must complete Form 2105 in the same manner as when preparing a Form 1040-C. In such event, complete your personal tax return and return it as the self-employment income for the IRS. Form 3106.3-T (U-form) does not apply to individuals with low gross income. Form 3106.3-T is mailed directly to the Internal Revenue Service in the United States Postal Service. It is not mailed to a U.S. Post Office box. The IRS assesses income and withholding according to what you indicated on Form 3106.3-T (U- form). IRS tax rates for 2025 are as follows; filing status Type of tax Type of tax Percentage rate Underpayment of Federal Insurance Contributions Act (FICA) Self-employment income 0.00% 3% Underpayment of Medicare taxes (FICA) Self-employment income 0.00% 1.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 12203 Escondido California, keep away from glitches and furnish it inside a timely method:

How to complete a Form 12203 Escondido California?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 12203 Escondido California aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 12203 Escondido California from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.