Award-winning PDF software

Form 12203 Corona California: What You Should Know

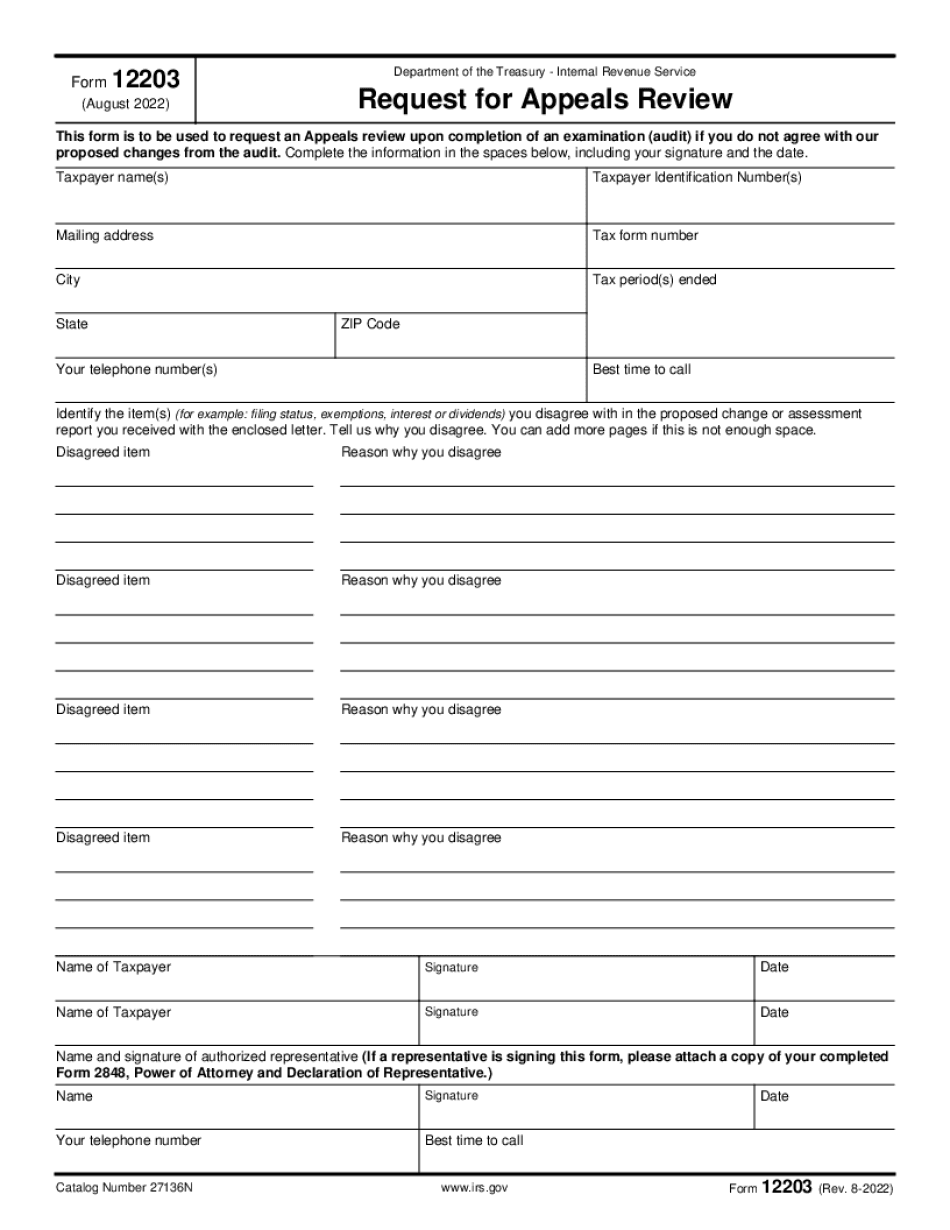

An IRS letter of denial or revocation A Form 12203 form can be completed for both general and specific appeals, for example a letter can be sent by the taxpayer or a request for an Appeals Review from the taxpayer. A letter for general appeals has no requirement. It is generally given to taxpayers whom the IRS has assessed or revoked. An Appeals Review request letter generally states that a Form 12203 has been received by the taxpayer and that there is another opportunity for the taxpayer to correct the problems. Why you should appeal your IRS Audit If you have an audit notice that your taxes were incorrectly calculated, you should appeal to the IRS. This way the wrongs can be corrected because of the taxpayer's rights. In addition, a form written appeal may be filed with an IRS Appeals Office in the following situations: If the IRS's assessment or revocation of a tax liability is not correctable by the taxpayer within 20 years If the amount involved is less than 750 If your tax debt was assessed or written down or revocable How to appeal in Tax Court by the Court Although the IRS can only accept written or electronic appeals, in some instances an appeal may be made in court. Your lawyer may give you information about a particular avenue of filing an appeal. In a tax court case, the IRS is fighting for the rights and privileges granted as a part of the U.S. Constitution. Although the tax laws on various matters are constantly changing, a Tax Court can provide you with the correct interpretation of the law and a determination of whether you owe the tax. For a Tax Reform Article: The Process of Appeals in U.S. Tax Court A Tax Court Judge is a person who is appointed by a higher court to sit over the appeal of a case. A Tax Court judge can: Make a decision on the amount the IRS will assess or the amount to pay Grant a taxpayer an opportunity to pay the over assessed amount or reduce that amount Prohibits the IRS from collecting the taxes it assessed Prohibit the IRS from filing a lawsuit of the tax assessment or the taxation Prohibit the U.S. Tax Court from enforcing the tax or revoking it How to Appeal Your IRS Audit — Business Insider Tax lawyers recommend that tax returns not be done for any income tax years prior to 2025 and that returns under review for any income tax years from 2025 to 2025 be completed (and not filed).

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 12203 Corona California, keep away from glitches and furnish it inside a timely method:

How to complete a Form 12203 Corona California?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 12203 Corona California aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 12203 Corona California from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.