Award-winning PDF software

Daly City California online Form 12203: What You Should Know

Tax Court — County of Riverside Exchange Form (Form 1042) by a CPA It's always good to know what you're doing before you go. A quick read of the IRS Publication 905 will help you with that process. If you're still reading, you're probably new to the tax process, and I am as well. It can be daunting to navigate the multiple online services you need to use for the filing of your taxes. Having a solid book helps you to feel comfortable navigating the options efficiently. A book like Tax Planning for the Individual Under Section 6662 of the Code of Federal Regulations, Tax Planning for Small Business, Tax Planning for Estates, Tax Planning for Corporations and Trusts, and Tax Planning for Estates and Trusts, is a solid choice. With it, you can find resources for your situation, and a wealth of information for those who would be filing on their own. If you are a homeowner with homeowners association taxes, then get this book: The Taxation Guide for Homeowners (2nd Edition) Tax software can help you to file your taxes more effectively and efficiently. My personal favorite is TurboT ax. There are a variety of software packages that can be installed online. The IRS can download your tax documents for you. This is often necessary for many tax situations and for those who have already lost their information. There are many ways you can file your taxes with the IRS online: You can use Form 1040A to pay your individual income tax and Social Security and Medicare tax. If your tax due is under 400 plus the applicable withholding, you can use Form 1040A. If your tax due is 400 plus or minus the applicable withholding, you can use Form 1040EZ with no additional filing requirements. If you are an HSA holder, then use Form 1095-A to pay your contributions to your health coverage and to your HSA for 2016, 2017, and 2018. If you are a non-qualified small business (NTSB) or non-qualified domestic relations donor, then use Form 1095-C to pay your qualified D&R distributions and to pay your qualified dividends and interest. There is no need for a tax return; all your paperwork is online. This may be a new experience for many, because it's the first time they've ever had any type of computer file.

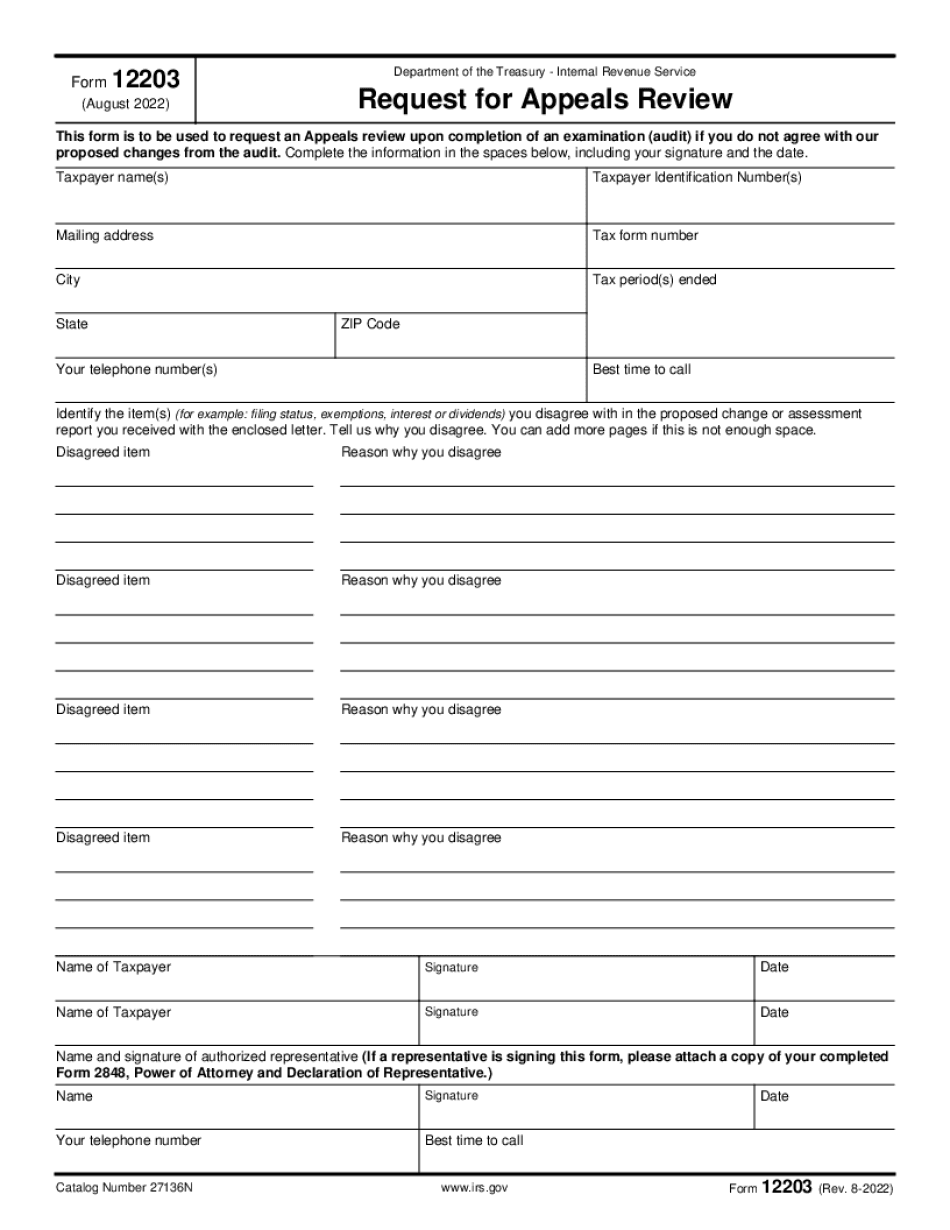

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Daly City California online Form 12203, keep away from glitches and furnish it inside a timely method:

How to complete a Daly City California online Form 12203?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Daly City California online Form 12203 aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Daly City California online Form 12203 from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.