Hi, I'm Tina Sacani from Herman J Property Realty Services. Thank you for inquiring about our taxable service here at NJ Property. We have been facilitating tax appeals and assisting homeowners in the tax appeal process for about eight years now. We work with various attorneys around the state of New Jersey who represent our clients in tax court. Let me explain the process of how we work. It's very simple. Basically, you're going to fill out the form below and provide us with as much detailed information about your property as possible. Additionally, please include three photos of your property - a front view, rear view, and side view. This will help us determine the style of property you have in comparison to others that we will be using as a basis for comparison. Here's what we do. We start off with a CMA, which stands for Comparative Market Analysis. It's basically a four to five-page report that explains the process we go through and all the calculations involved in determining the actual tax appeal calculations for your property. We use your town's rate and ratio to analyze this. Based on our findings, we will explain to you whether your property qualifies for an appeal. The cost for preparing this report is $175. Most other companies will tell you that you need to get a tax appeal appraisal right from the start, which can cost anywhere from $350 to $450 for a single-family home. However, we have streamlined the process to save you money. For just $175, we can determine if your property qualifies for an appeal. If you decide to proceed with the tax appeal process, we will refer you to one of our attorneys. At that point, you will need a tax appeal appraisal, but we will credit you the...

Award-winning PDF software

Bergen county tax appeal Form: What You Should Know

Tax Appeal Authority (or NJ Department of Taxation) Appeals Tax The Tax Appeals Authority (TAA) is a public body established under section 1 of the New Jersey Taxation Law. It is organized by an executive board, one executive officer, four staff members and the Secretary. TAA's function is defined as administering a tax appeal procedure and a reviewing board of three members, including the taxpayer. The appeal procedure may be filed either as a formal application made to TAA by the taxpayer or a request to be considered on behalf of the taxpayer if a request to be considered on behalf of a taxpayer is already in effect. A taxpayer seeking appeals must comply with the guidelines. Tax appeal guidelines : 1. An application for an appeal must be filed by a taxpayer. 2. The application must be in writing. No person may receive a tax appeal and the request for an in person hearing must be made by one person. 3. If a taxpayer's application is rejected, the taxpayer shall, within 10 days, file another application properly. If the tax appeal procedure is not appealed within the 10-day period for filing a properly, the tax will be assessed. 4. Taxpayers are provided a notice of assessment or proposed assessments that states the tax decision, along with a copy of the complaint, notice of appeal and request for an in person hearing. 5. The notice of assessment or proposed assessment must be returned to the tax assessor within 10 days after the taxpayer's filing, indicating the assessed value(s) of the subject property. 6. The Tax Review Board of the Tax Court has jurisdiction over appeals of an assessor's decision to issue or proposed determination of valuation. The decision of the Tax Review Board is binding on parties of interest in the appeal with respect to the value of the subject property, as provided for in section 515. The Tax Court has the authority to deny the taxpayer's request to be considered unless the Tax Review Board refuses to hear the appeal because the Tax Court determines that the Tax Court cannot have the authority to review the Tax Court's decision to issue or proposed determination of valuation. The Tax Court may take judicial notice of the Tax Review Board's determination and may grant the taxpayer's motion for special leave of judicial review. 7.

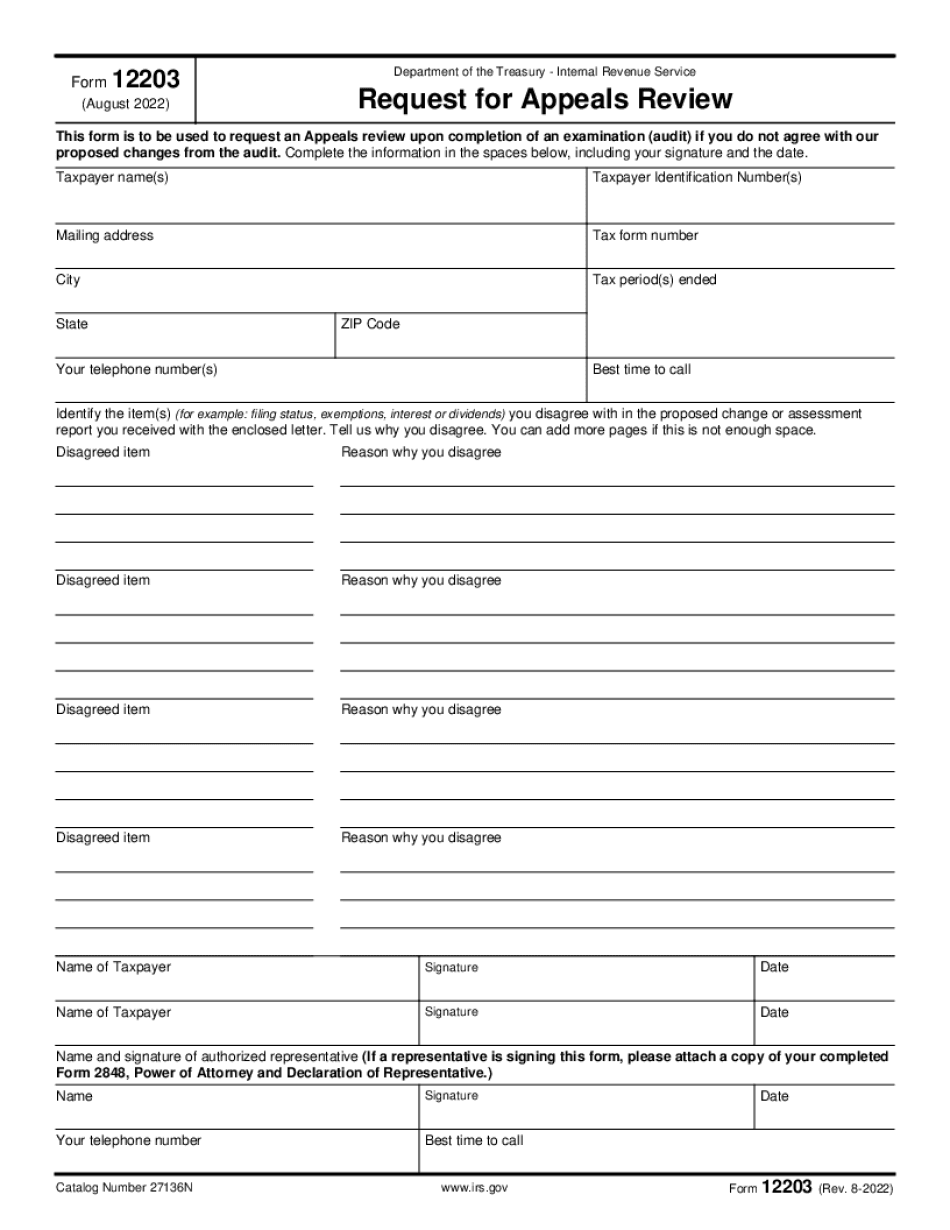

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 12203, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 12203 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 12203 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 12203 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Bergen county Tax Appeal Form