Award-winning PDF software

Nj property tax appeal Form: What You Should Know

Property Tax Filing Fee Schedule. Civil Action Notice of Appeal — In Form C-1. (Download Form C-1) Dec 28, 2025 — This is an informational form that describes the process for filing a civil action against a tax collector or tax authority. All cases are reviewed by a County Court judge. (File an Original Case Form if filing a civil action directly against your assessor.) If you wish to know if this is something that you could file yourself, check out the above link, to see information about how to file your own case if the assessor has violated your rights. A civil action is an action in which you bring a claim in connection with the taxation of property. In addition to the filing of any necessary paperwork and supporting papers, you must follow the rules and procedures described in the Civil Action Notice of Appeal forms linked above. You must have a letter of complaint, signed and notarized, in writing, explaining the facts and circumstances of your complaint and a request for an Administrative Hearing if requesting an Administrative Hearing. If you decide not to pursue a civil complaint through the Civil Action Notice of Appeal, you may then file a lawsuit in the County Court of your County of Assessments. (For information on obtaining civil lawsuits in the NJ courts, click here. If you are filing for a small amount of money, you may file for no fee. For a more serious action (for a 10,000 or more tax assessment), you may obtain civil action for a reasonable fee in the county of the property assessment. To file your case for a small amount of money, contact the Tax Commission on the NJ Board of Assessors at or toll-free to speak with a staff person about filing a case for a small amount of money. (You may also file an appeal of your assessment with the County Court of your county of assessment for no fee. The County Court has 3 levels of courts to hear minor cases and appeals.) Your complaint must be filed prior to the Assessment Roll date. Note that there is NO “pre-acution” on your complaint, so for the most up to date action on your case, you will need to file your complaint by your Assessment Roll date. There is a specific deadline for filing your complaint (see the “Civil Action” Notice of Appeal form linked above).

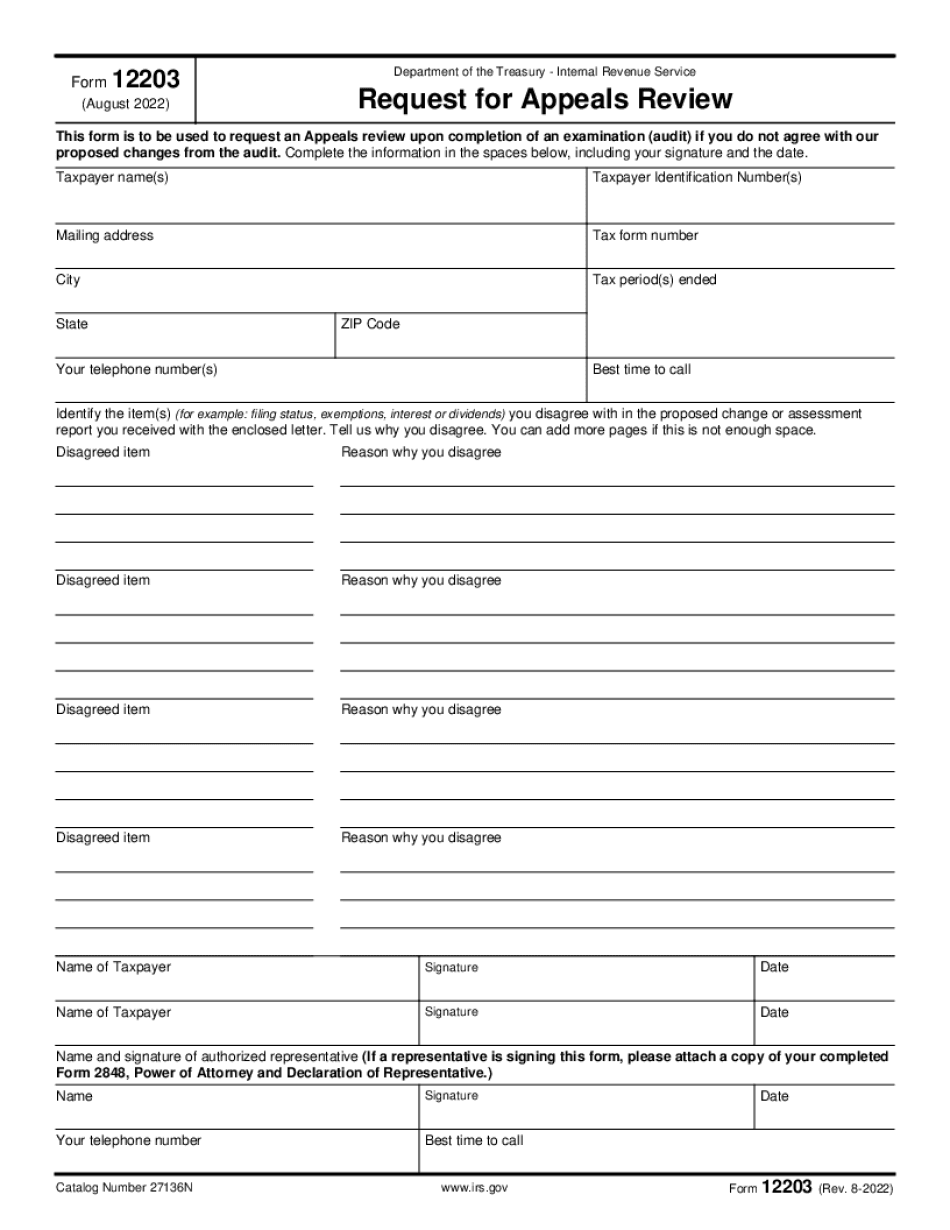

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 12203, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 12203 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 12203 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 12203 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.