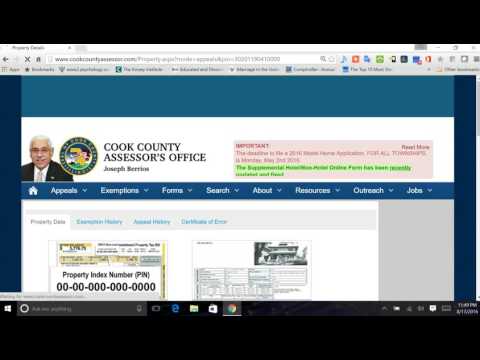

In order to file an appeal with the Cook County Assessor, there are a few steps you need to follow. First, go to the Cook County Assessor Appeals website and enter the necessary information. This will bring up the appeal and closing deadlines for the Cook County Assessor. Next, scroll down and locate your Township to see where it falls in the appeal cycle. For example, if your property is in Thornton Township and the notices were mailed on August 16th, the appeals are currently open. The column will provide the last day appeals are accepted, which in this case is September 16th. To file an appeal on a property in Thornton Township, click on the third option which says "file a residential appeal" under the "Appeals" section. Then, enter your PIN number, which can be found on your property tax bill. If you don't have the PIN number, there is a separate tutorial that can help you locate it and find comparable properties. Enter the CAPTCHA code and hit search to proceed. The system will bring up a screen where you can file a new appeal. It will display the name on the property tax bill, which you can change to your own name. It will also display the address, which you should ensure is spelled correctly. Enter a daytime phone number and then select the reason for the appeal. In this case, select "over evaluation," but it's important to choose the reason that accurately represents your situation. If there are multiple parcels, input that information as well. You have the option to use comparable properties as evidence, but in this instance, the contention is that the purchase price reflects the property's value. Click "Next" to proceed. The system will display the information associated with the property as per...

Award-winning PDF software

Tax Appeal Form: What You Should Know

This should be done by filling out and sending to the Board within 30 days after the tax assessment was assessed. Please see the instruction section provided below Form 1023-ESP (For Single Individual) (for use by Board Clerks) Notice of appeal of tax liability (notice to be served by filing with the Tax Clerk's office the tax appeal) PDF, or, Notice of Appeal PDF (for use by Tax Clerks) Use Form 1115 for a complete list of items to be added to Form 1115. Form 1115 is for use by Tax Clerks. Forms 1101, 1110 & 1112 (for use by Tax Clerks) Use Form 1115 for a complete list of items to be added to Form 1115. Form 1115 is for use by Tax Clerks. Please note for electronic filing of the tax appeal form, there are special instructions for filing. See Form 1115 (for use by Tax Clerks) Form 1112 (for use by Tax Clerks) You may download forms from the links below. If you find a form not on the list below, let us know to add it to the forms list. Form 1115 (for use by Tax Clerks) Form 1111 (for use by Tax Clerks) Use our form to submit your tax refund or credit request with Form 2112.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 12203, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 12203 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 12203 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 12203 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Tax appeal